What is TD Ameritrade?

TD Ameritrade is a prominent online brokerage firm that provides a wide range of financial services to individual investors and traders. Founded in 1975, TD Ameritrade offers a comprehensive suite of investment products, advanced trading platforms, and educational resources for both novice and experienced traders.

In 2020, TD Ameritrade was acquired by Charles Schwab Corporation, and the two companies are in the process of integrating their operations.

Here are some key aspects of TD Ameritrade:

- Brokerage Services: TD Ameritrade allows investors to trade a variety of financial instruments, including stocks, options, futures, mutual funds, exchange-traded funds (ETFs), bonds, and foreign currencies. It offers self-directed trading as well as managed portfolios through its robo-advisory service called Essential Portfolios.

- Trading Platforms: TD Ameritrade provides several trading platforms to suit different levels of expertise and trading styles. The flagship platform is thinkorswim, which offers advanced tools and features for active traders. It includes real-time streaming quotes, customizable charts, technical analysis tools, backtesting capabilities, and access to news and research.

- Mobile Trading: TD Ameritrade offers mobile trading apps compatible with iOS and Android devices. These apps allow clients to monitor their accounts, place trades, access real-time quotes, set up alerts, and manage their portfolios on the go.

- Investor Education: TD Ameritrade places a strong emphasis on investor education. It provides a wide range of educational resources, including articles, videos, webinars, tutorials, and in-person events. The thinkorswim platform also offers paper trading, allowing users to practice trading strategies without risking real money.

- Research and Analysis: TD Ameritrade offers comprehensive research tools and resources to assist investors in making informed decisions. It provides access to third-party research reports, analyst ratings, earnings calendars, market news, and proprietary research from TD Ameritrade’s team of analysts.

- Retirement Accounts: TD Ameritrade supports various retirement account types, including Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, and 401(k) rollovers. It offers retirement planning tools and guidance to help clients with their long-term investment strategies.

- Customer Service: TD Ameritrade provides customer support through various channels, including phone, email, and online chat. It also maintains a network of branch offices across the United States where clients can receive in-person assistance.

It’s worth noting that following the acquisition of TD Ameritrade by Charles Schwab, the two companies are working towards integrating their operations. As a result, some aspects of TD Ameritrade’s services may change or be consolidated with Charles Schwab’s offerings.

It’s recommended to visit the official TD Ameritrade or Charles Schwab websites for the most up-to-date information.

How does TD Ameritrade Make Money?

TD Ameritrade generates revenue through various sources related to its brokerage and financial services. Here are some primary ways TD Ameritrade makes money:

- Commissions: One of the significant revenue streams for TD Ameritrade is transaction-based commissions. When clients trade securities such as stocks, options, futures, or other financial instruments, TD Ameritrade charges a commission or fee for executing those trades. The commission structure may vary depending on the type of trade and the client’s trading volume.

- Order Routing and Payment for Order Flow: TD Ameritrade receives payment for order flow (PFOF) from market makers and exchanges. When customers place trades, TD Ameritrade may route those orders to specific market makers who pay TD Ameritrade to direct the order to them. This practice helps market makers fulfill trades and provides liquidity to the market. In return, TD Ameritrade receives compensation from these market makers.

- Interest Income: TD Ameritrade holds cash balances and securities on behalf of its clients. These balances generate interest income for TD Ameritrade. The company may invest the cash balances in low-risk instruments such as Treasury bonds or other short-term investments. The interest earned on these investments contributes to TD Ameritrade’s revenue.

- Asset-Based Fees: TD Ameritrade offers managed portfolios through its robo-advisory service called Essential Portfolios. Clients who opt for this service pay asset-based fees. The fees are typically a percentage of the client’s invested assets and are charged periodically (e.g., quarterly). These fees provide a recurring source of revenue for TD Ameritrade.

- Margin Interest: TD Ameritrade allows eligible clients to trade on margin, which means borrowing funds from TD Ameritrade to leverage their trading positions. Clients pay interest on the borrowed amount, and this interest income contributes to TD Ameritrade’s revenue.

- Mutual Fund Fees: TD Ameritrade offers access to a wide range of mutual funds, including both no-load and load funds. Load funds charge sales commissions, commonly known as front-end loads or back-end loads. TD Ameritrade may receive a portion of these sales commissions as revenue.

- Other Services: TD Ameritrade may generate revenue through other services, such as account maintenance fees, inactivity fees, account transfer fees, and fees for additional services like paper statements or research subscriptions.

It’s important to note that specific fee structures and revenue sources may change over time, especially after the integration of TD Ameritrade with Charles Schwab. Clients should refer to the official TD Ameritrade or Charles Schwab websites for the most up-to-date information on fees and revenue sources.

TD Ameritrade Institutional

TD Ameritrade Institutional is a division of TD Ameritrade that specifically caters to registered investment advisors (RIAs), independent financial advisors, and other institutional clients. It provides a range of services and supports tailored to the needs of these professionals.

Here’s a complete overview of TD Ameritrade Institutional:

- Custodial Services: TD Ameritrade Institutional offers custodial services to RIAs and independent advisors. This includes providing a platform for holding and safeguarding client assets, facilitating trade execution, and maintaining custody records. TD Ameritrade acts as a custodian for the assets managed by the advisors.

- Technology and Trading Platforms: TD Ameritrade Institutional provides access to a suite of advanced technology tools and trading platforms designed to support advisors in their day-to-day operations. This includes thinkorswim, a robust trading platform with advanced charting and analysis capabilities, as well as other portfolio management, reporting, and rebalancing tools.

- Practice Management: TD Ameritrade Institutional offers practice management resources and consulting services to help advisors grow and manage their businesses effectively. These resources cover a wide range of topics, including business planning, client acquisition and retention, compliance support, succession planning, and operational efficiency.

- Education and Training: TD Ameritrade Institutional provides educational resources and training programs to help advisors enhance their knowledge and skills. This includes webinars, workshops, conferences, and access to a library of industry research and insights. The aim is to support advisors in staying informed about industry trends and best practices.

- Advisor Advocacy: TD Ameritrade Institutional serves as an advocate for independent advisors and the RIA industry. They actively engage with regulatory bodies, industry associations, and policymakers to represent the interests of advisors and provide input on important issues affecting the industry.

- Advisor Support: TD Ameritrade Institutional has a dedicated team of service professionals who provide support and assistance to advisors. This includes help with account setup, technology integration, trading support, and general inquiries. Advisors can access support through various channels, including phone, email, and online chat.

- Networking and Collaboration: TD Ameritrade Institutional facilitates networking and collaboration opportunities among advisors through events, conferences, and online communities. These platforms allow advisors to connect with peers, share ideas, and learn from one another.

- Specialized Services: TD Ameritrade Institutional offers additional specialized services, such as trust services, access to alternative investments, and institutional-grade research and due diligence. These services are designed to meet the unique needs of institutional clients and their specific investment strategies.

It’s important to note that as a result of the acquisition of TD Ameritrade by Charles Schwab, some services and offerings may be integrated or transitioned into Charles Schwab’s platform.

Advisors and institutional clients should refer to the official TD Ameritrade or Charles Schwab websites for the most up-to-date information on TD Ameritrade Institutional’s services and support.

TD Ameritrade App

TD Ameritrade is an online brokerage firm that provides a range of investment and trading services to individual investors. The TD Ameritrade app is a mobile application offered by TD Ameritrade that allows users to manage their investment accounts, trade stocks and other securities, access market data, and perform various financial transactions using their mobile devices.

Here is some complete information about the TD Ameritrade app:

Key Features:

- Account Management: The app provides users with easy access to their TD Ameritrade brokerage accounts, allowing them to view balances, positions, transaction history, and account statements.

- Trading: Users can trade a variety of securities, including stocks, options, futures, and mutual funds. The app offers real-time quotes, advanced charting tools, and order placement capabilities.

- Market Data and Research: Users can access real-time streaming quotes, market news, and research reports to make informed investment decisions.

- Watchlists and Alerts: The app allows users to create custom watchlists to monitor their favorite stocks and set up price and news alerts for specific securities.

- Education and Learning Resources: TD Ameritrade provides educational content within the app, including articles, videos, webinars, and courses to help users improve their investing knowledge and skills.

- Mobile Deposits: Users can conveniently deposit checks into their TD Ameritrade accounts using the app’s mobile deposit feature.

- Transfer Funds: The app enables users to transfer funds between their TD Ameritrade accounts and linked external bank accounts.

- Face ID/Touch ID: Users can enable biometric authentication, such as Face ID or Touch ID, to securely access their accounts.

Availability:

The TD Ameritrade app is available for download on iOS and Android devices. Users can find the app on the respective app stores (Apple App Store and Google Play Store) and install it on their smartphones or tablets.

Account Types:

The app supports various types of TD Ameritrade accounts, including individual brokerage accounts, joint accounts, retirement accounts (IRAs), education savings accounts (ESAs), and trusts.

Trading Fees and Commissions:

TD Ameritrade offered commission-free online trading for stocks, ETFs, and options trades. However, it’s essential to note that pricing and fee structures may have changed, and it’s advisable to check TD Ameritrade’s official website or contact their customer service for the most up-to-date information on fees and commissions.

Integration with Other TD Ameritrade Services:

The TD Ameritrade app seamlessly integrates with other TD Ameritrade platforms and services. For example, users can access their accounts and trade on the go using the TD Ameritrade website on desktop or laptop computers.

Security:

TD Ameritrade takes security seriously and employs several measures to protect user information and transactions. These include encryption technology, firewalls, account protection features, and secure login methods.

It’s important to note that the features and functionality of the TD Ameritrade app may evolve, and it’s advisable to visit the TD Ameritrade website or contact their customer support for the most up-to-date information and guidance on using the app.

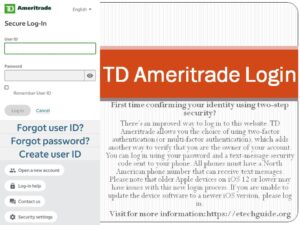

Complete TD Ameritrade Login Guide

Here’s a step-by-step guide to help you with the TD Ameritrade login process:

- Visit the official TD Ameritrade website. You can access it by typing “www.tdameritrade.com” into your web browser’s address bar or by conducting a search engine query for “TD Ameritrade.”

- Once on the TD Ameritrade homepage, locate the “Log In” button or link. It is usually located in the upper-right corner of the page. Click on it to proceed to the login page.

- On the login page, you will see two main options: “Client Login” and “Advisors Login.” Select the “Client Login” option as it is for individual investors and traders.

- Enter your TD Ameritrade account credentials. These typically consist of your unique User ID and your password. If you haven’t set up an account yet, you may need to click on the “Open New Account” or “Sign Up” button to create one.

- After entering your User ID and password, you may have the option to select whether you want TD Ameritrade to remember your User ID for future logins. This is a convenient feature, and you can choose whether or not to enable it based on your preference.

- Once you’ve entered your login credentials and made any desired selections, click on the “Log In” or “Sign In” button to proceed.

- If the information you entered is correct, you will be granted access to your TD Ameritrade Login account. You should now be able to view your account details, access trading platforms, perform transactions, and utilize other features provided by TD Ameritrade.

- If you encounter any issues logging in, such as a forgotten password, TD Ameritrade typically provides options for account recovery or password reset. Look for links or prompts on the login page to initiate these processes.

Please note that the login process and interface may vary slightly depending on any updates or changes made by TD Ameritrade or Charles Schwab following their integration. If you encounter any difficulties or have specific questions about your TD Ameritrade account, it’s recommended to reach out to TD Ameritrade customer support for further assistance.

TD Ameritrade Customer Service

TD Ameritrade provides customer service through various channels to assist clients with their inquiries, account-related questions, technical support, and other concerns. Here’s a comprehensive overview of TD Ameritrade’s customer service options:

- Phone Support: TD Ameritrade offers phone support to clients 24 hours a day, 7 days a week. You can contact the customer service team by calling the appropriate phone number based on your specific needs. The phone numbers are typically provided on the TD Ameritrade website or on your account statements. Note that wait times may vary depending on call volume.

- Live Chat: TD Ameritrade offers a live chat feature on its website. This option allows you to communicate with a customer service representative in real time via text chat. Live chat is available during business hours and can be a convenient way to get quick answers to your questions.

- Email Support: TD Ameritrade provides an email support option for clients who prefer to communicate via email. You can typically find the email address for customer support on the TD Ameritrade website. It’s important to provide detailed information and include your account details when contacting them via email to ensure a prompt and accurate response.

- In-Person Assistance: TDAmeritrade has a network of branch offices across the United States where you can receive in-person assistance. These branch offices offer services such as account opening, investment guidance, education, and general customer support. You can find the nearest TD Ameritrade branch location on their website or by contacting customer service.

- Social Media: TDAmeritrade maintains a presence on various social media platforms, including Twitter and Facebook. While social media channels may not be the most direct way to resolve complex issues, they can be useful for general inquiries or to stay updated on TD Ameritrade news and announcements.

- Support Center and FAQs: TD Ameritrade has an online support center that provides a wealth of resources, including FAQs, guides, tutorials, and troubleshooting tips. You can access the support center through the TD Ameritrade website and search for answers to common questions or browse through the available resources.

When reaching out to TD Ameritrade customer service, it is helpful to have your account information readily available to expedite the process. This may include your account number, User ID, and any relevant details related to your inquiry or issue.

It’s important to note that following the acquisition of TD Ameritrade by Charles Schwab, customer service processes and contact information may undergo changes or be consolidated with Charles Schwab’s services. Therefore, it’s recommended to refer to the official TDAmeritrade or Charles Schwab websites for the most up-to-date and accurate customer service information.

TD Ameritrade Phone Number

Regular TD Ameritrade support is available 24/7.

TD Ameritrade Technical Support is available from 7:00 a.m. to 6:00 p.m. ET, Monday through Friday.

I can provide you with general information on how to find the phone numbers for TD Ameritrade’s customer service.

To contact TD Ameritrade by phone, you can follow these steps:

- Visit the official TD Ameritrade website at www.tdameritrade.com.

- Scroll to the bottom of the page and look for the “Support & Contact” or “Contact Us” link. Click on it to access the contact information.

- On the “Contact Us” page, you should find a list of contact options, including phone numbers.

- Look for the phone number that corresponds to your specific needs. TD Ameritrade may have different phone numbers for general inquiries, technical support, account-related questions, or specific services like retirement accounts or margin trading.

- Make note of the phone number that is most relevant to your inquiry and dial it using your phone.

If you’re unable to find the phone number on the TD Ameritrade website, you can also try searching online directories or contacting TDAmeritrade through their official social media channels to inquire about the appropriate phone number to reach their customer service.

It’s important to note that following the acquisition of TD Ameritrade by Charles Schwab, there may be changes to contact information and phone numbers. Therefore, it’s recommended to visit the official TD Ameritrade or Charles Schwab website for the most up-to-date and accurate phone numbers for customer service.

2 thoughts on “What is TD Ameritrade?”